The Global

Cryptocurrency

Exchange

Making Crypto Trading Easier

The Global Cryptocurrency Exchange

Making Crypto Trading Easier

-

BTC/USDTLoading...Loading...

BTC/USDTLoading...Loading... -

ETH/USDTLoading...Loading...

ETH/USDTLoading...Loading... -

LTC/USDTLoading...Loading...

LTC/USDTLoading...Loading... -

XRP/USDTLoading...Loading...

XRP/USDTLoading...Loading... -

ADA/USDTLoading...Loading...

ADA/USDTLoading...Loading... -

DOT/USDTLoading...Loading...

DOT/USDTLoading...Loading... -

BNB/USDTLoading...Loading...

BNB/USDTLoading...Loading... -

SOL/USDTLoading...Loading...

SOL/USDTLoading...Loading... -

DOGE/USDTLoading...Loading...

DOGE/USDTLoading...Loading... -

UNI/USDTLoading...Loading...

UNI/USDTLoading...Loading... -

AVAX/USDTLoading...Loading...

AVAX/USDTLoading...Loading...

Rankings

More| Coins | Price [USD] | 24H Change | Market Cap [USD] |

|---|

Crypto News

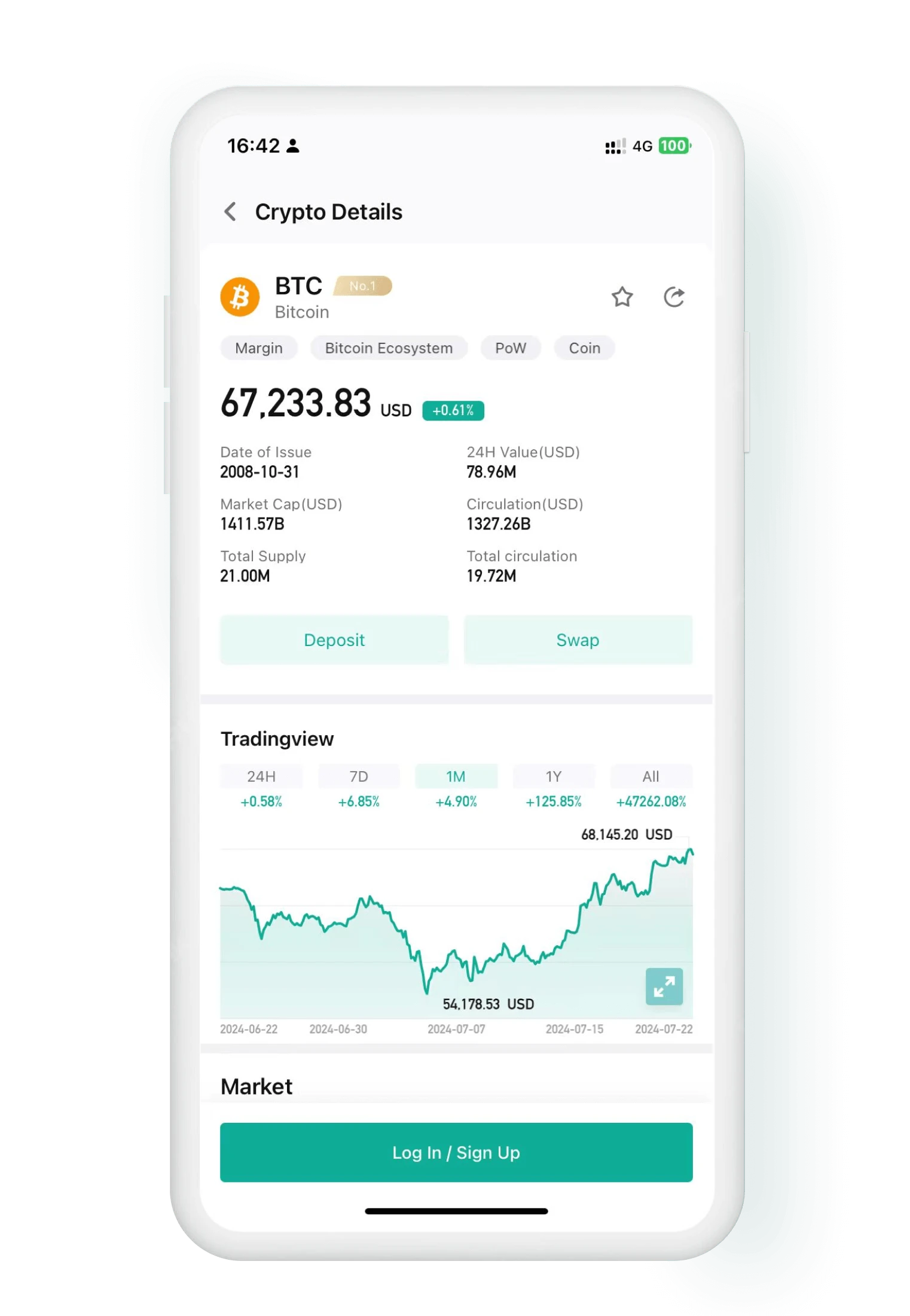

Trade crypto. Anytime.

Anywhere.

- Thousands of assets in the palm of your hand

- Powering 10, 000 transactions per second

- In-depth market analysis

FAQs

Forgot the funds password processing method for platform transactions

If you forget the trading fund password on the platform,please go to "My-Settings-Click SetFund Password" or contact customer service to reset

What is the value of the stop loss and profit setting in opening a position?

How should it be set?

Take profit and stop loss as the upper limit of profit and loss set by

you. When the set amount ofstop profit and stop loss is reached, the system will

automatically close the position. It can be usedfor risk control when you buy a

contract. Half of the set profit-taking amount is: amount of increasex quantity x

leverage multiple, set stop loss.

We recommend that you set it according to your actual asset situation and reasonably

controlthe risk.

How to reduce contract risk?

You can transfer the available assets of the remaining accounts to the contract account bytransferring funds, or reduce the risk by reducing the open positions.

What does the quantity in the contract opening mean?

The quantity in the open position represents the number of currencies you expect to buy. Forexample: select on the opening page of the BTC/USDT trading pair, buy long, enter the price as1000USDT, and enter the amount as 10BTC, it means: you expect to buy 10 BTC with a unit price of1000USDT.

How is the handling fee in the contract calculated?

Handling fee-opening price*opening quantity*handling fee rate

Notes on forced liquidation

Risk is a measure of the risk of your assets. When the risk is equal to 100%, your position isregarded as a liquidation, and the risk = (position margin/contract account equity) *100%, in order to prevent users from penetrating the position, the system sets the risk adjustmentratio. When the risk reaches the risk value set by the system, the system will force the position tobe closed. For example: the adjustment ratio set by the system is 10%, when your risk is greaterthan or equal to 90%, all your positions will be forced to liquidate by the system Note: If the system's forced liquidation is caused by excessive risk, all your positions will beliquidated. Therefore, I hope you can reasonably control your risk to avoid unnecessary losses.

What are the contract trading rules?

Transaction type

Trading types are divided into two directions: long positions(buy) and short positions

(sell):

Buy long (bullish) means that you think that the current index is likely to rise, and

you want to buya certain number of certain contracts at the price you set or the current

market price.

Sell short (bearish) means that you think that the current index is likely to fall, and

you want to sellla certain number of new contracts at a price you set or the current

market price.Ordering methodLimited price order: you need to specify the price and

quantity of the order placed

Market order: you only need to set the order quantity, the price is the current market

pricePositions

When the order you submit for opening a position is completed, it is called a position

Contract delivery issues

The platform contract is a perpetual contract with no set delivery time. As long as the

system doesnot meet the conditions for liquidation or you do not manually close the

position, you can hold theposition permanently.

System liquidation

1: The system will automatically close the position if the set value of Take Profit and

Stop Loss isreached

2: The risk is too high, the system is forced to close the position

What are limit order and market order?

The limit order refers to the price you expect to entrust the platform

to trade, and the marketorder refers to the direct entrustment of the platform to trade

at the current price. In the rules foropening a position, market orders take precedence

over limit orders.

If you choose a limit order, please open a position reasonably based on the current

currencymarket price to avoid losses due to unreasonable opening prices

What does the risk level of contract transactions represent

Risk degree is a risk indicator in your contract account . A risk degree equal to 100% isconsidered as a liquidation. We suggest that when your risk exceeds 50%, you need to open yourposition carefully to avoid losses due to liquidation. You can reduce your risk by replenishing theavailable funds of contract assets, or reducing your positions.

Why is currency exchange necessary?

The purpose of the exchange is to allow the smooth circulation of funds in different currencies inyour assets, and the QcC obtained in the futures account can be freely converted into USDT fortrading. USDT in other accounts can also be freely converted to QcC for trading.

How to buy USDT through the platform?

Method 1: Select the order you want to buy through the platform buy and

sell list to buy and sell.

Method 2: Click the publish button to publish a buy or sell order for quick transactions

according to your needs

The system will quickly match you with buying and selling users.Note: If the purchase

order is notpaid after 15 minutes, the system will automatically cancel the order,

please pay in time. If the orderis cancelled more than 3 times on the same day, the

transaction cannot be performed again on thesame day, and the trading authority will be

restored the next day

Why does the converted amount of assets change?

The equivalent calculation in the asset is the value of the current holding digital currency converted into USDT, which changes due to the price fluctuation of the digital asset. The number of your digital assets has not changed.